Governance Initiatives

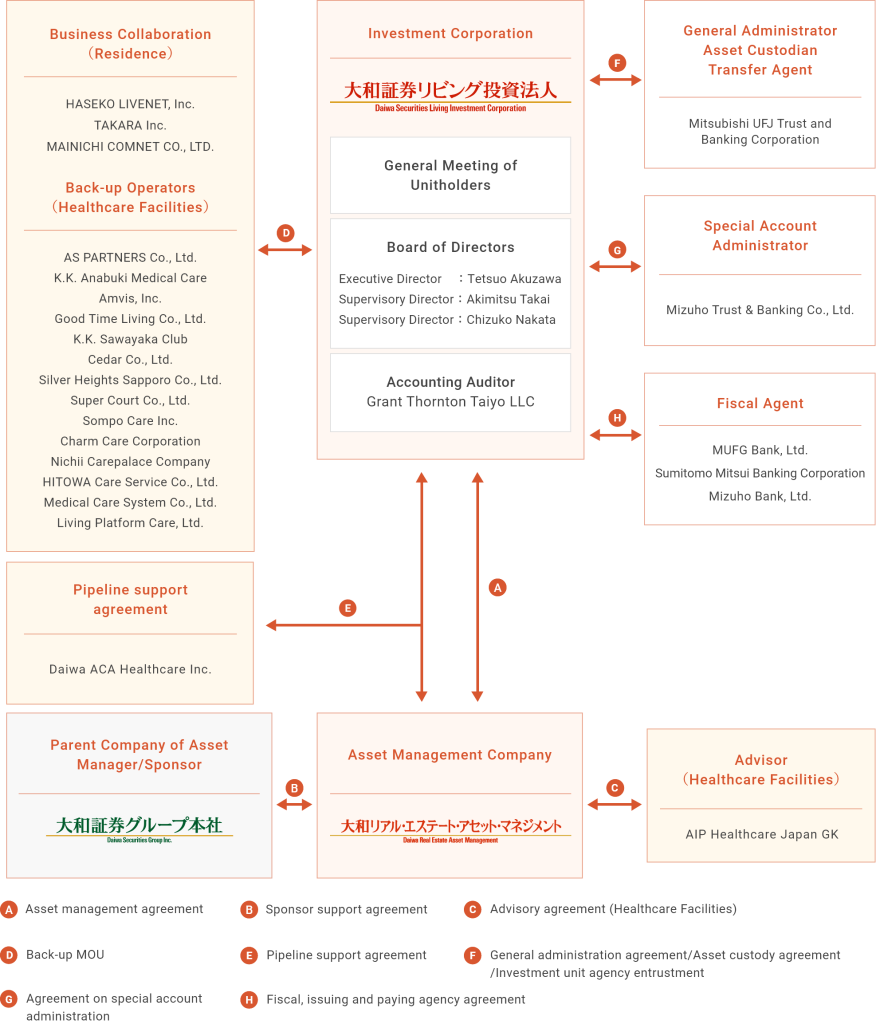

Investment Corporation Institutions/Management Structure

Investment Corporation Institutions

In addition to the General Meeting of Unitholders composed of investment unitholders, the Investment Corporation’s institutions include a Board of Directors, composed of one executive director and two supervisory directors, and an Accounting Auditor.

Institutions

(a)General Meeting of Unitholders

Certain resolutions, which are stipulated in the Act on Investment Trusts and Investment Corporations or the articles of incorporation, are adopted at the General Meeting of Unitholders. Unless otherwise stipulated in the law or articles of incorporation, resolutions of the General Meeting of Unitholders shall be adopted by a majority of the voting rights of the unitholders present. However, for certain important matters such as amendments to the articles of incorporation, resolutions (special resolutions) must be adopted by two-thirds or more of the voting rights of the unitholders present at a meeting where unitholders holding a majority of the investment units issued and outstanding are present.

(b)Executive Director, Supervisory Directors & Board of Directors

The executive director has the authority to execute the business of the Investment Corporation and to represent the Investment Corporation in all judicial or extrajudicial acts related to its business. The supervisory directors have the authority to supervise the executive director's execution of duties. The Board of Directors, which is composed of all executive directors and supervisory directors, has the authority to approve the execution of certain duties, the authority stipulated in the Investment Trust Act and the articles of incorporation and the authority to supervise the executive director's execution of duties.

(c)Accounting Auditor

The Investment Corporation has appointed Grant Thornton Taiyo LLC as its accounting auditor. The Accounting Auditor shall audit the Investment Corporation's financial statements, report to the supervisory directors any wrongful act or material fact in violation of the law or articles of incorporation it discovers in connection with the executive director's execution of duties, and perform other legally stipulated duties.

Structure

Investment Corporation Management Structure

The Investment Corporation entrusts its asset management to Daiwa Real Estate Asset Management Co., Ltd.

Click here for The Asset Manager’s organizational structure

Performance-Based Management Compensation

| Type | Calculation method |

| Management Fee1 | Total asset value × 0.20% (annual) |

| Management Fee2 | Income before tax × 8.0% |

| Acquisition Fee | 【Rental housing】 Acquisition price ×1.0% 【Healthcare facility】 Acquisition price×1.5% |

| Transfer Fee | Transfer price × 0.5% |

| Merger Fee | Succeeded asset value ×1.0% |

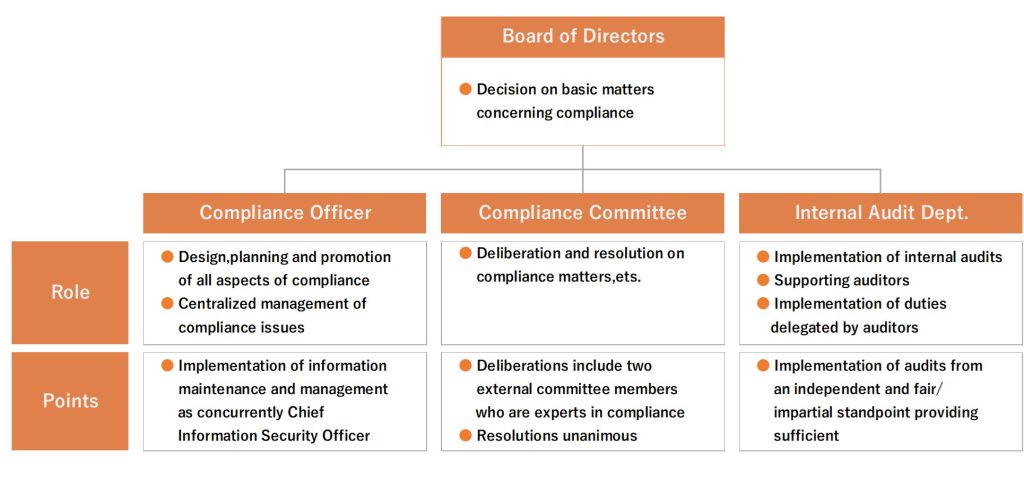

Compliance Structure

Compliance Structure

The Asset Manager is committed to honest and fair corporate activities, not only in strict compliance with all laws and regulations related to its operations, various regulations, bylaws and market rules but also in full awareness of social norms.

Appropriate Management of Conflicts of Interest

In cases where transactions may be at risk of conflicts of interest concerning the financial instruments business or other related operations, the Asset Manager shall comply with the Financial Instruments and Exchange Act, the Act on Investment Trusts and Investment Corporations and other related laws and regulations, and the separately provided rules on measures against conflicts of interest. The rules on prevention of conflicts of interest provide the following terms and conditions individually for each of the following transactions.

①Asset Acquisition

In case of acquiring real estate or real estate trust beneficiary rights from interested parties, the acquisition price shall be at 100% or less of the appraisal value as appraised by a real estate appraiser. In the case of other assets, the acquisition shall be made at fair value price. However, if the fair value measurement is not applicable, the acquisition shall be at the value reasonably estimated by an expert independent from the asset management company.

②Other

In cases other than asset acquisition, such as asset sale, asset leasing, entrustment of property management operations, entrustment of intermediation operations for real estate acquisition, sale or leasing and placement of construction orders, where such involves interested persons, the transaction shall be implemented in line with the rules on measures against conflicts of interest.

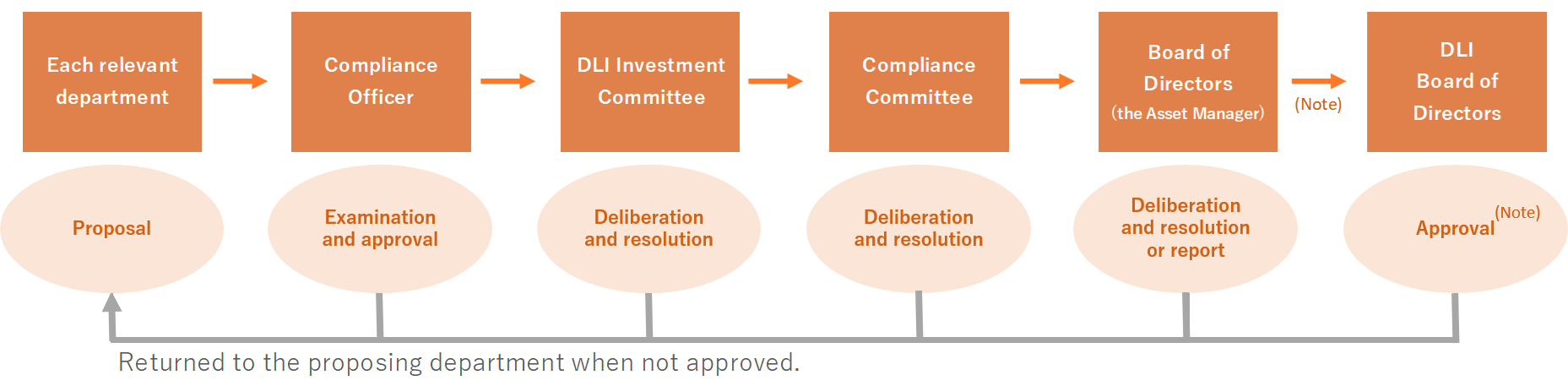

Investment decision-making system

As an asset management company under the Act on Investment Trusts and Investment Corporations that is entrusted with asset management by the Investment Corporation, the Asset Manager prepares, in line with the Articles of Incorporation, asset management guidelines to stipulate basic approaches to investment management, such as the investment policy, rules on transactions with interested parties regarding acquisition and sale of assets, etc. and the disclosure policy.

Decision-making process

(Note)When transacting (acquiring or transferring real estate or securities, or leasing) with interested persons under the Act on Investment Trusts and Investment Corporations, approval by the Board of Directors of the Investment Corporation is required except for certain cases.

Note that a proposal shall be returned to the proposing department when examination by the Compliance Officer or deliberation by the DLI Investment Committee, Compliance Committee or Board of Directors results in approval not being obtained. In addition, for agenda resolved at a meeting of the DLI Investment Committee, Compliance Committee or Board of Directors, parties having special vested interest shall not be eligible to exercise voting rights on the concerned resolved agenda.

Prevention of Conflicts of Interest among Funds

In case of competition over a property acquisition opportunity among the Investment Corporation and other funds, etc. managed by the Asset Manager, conflicts of interest among the Investment Corporations and other funds, etc. shall be prevented by first granting the Investment Corporation the preferential right to consider the acquisition. The acquisition opportunity will be available to the other funds, etc. only when the Investment Corporation decides not to exercise the concerned preferential right.

Furthermore, in the case of rental residences, the Asset Manager shall prevent arbitrary distribution of property information and avoid conflicts of interest among the Investment Corporation, Daiwa Residential Private Investment Corporation and other funds, etc. by establishing the "Rotation Rule."

Establishment of Tax Policy

Daiwa Securities Group has enacted "Daiwa Securities Group Tax Policy" in aiming to develop corporate tax governance, and describes our code of conduct and standard of judgments in taxation.

For details, please click here

Prevention of corruption

In line with the principles of the United Nations Global Compact, Daiwa Securities Group works to prevent corruption. The Code of Ethics and Conduct, which guides the actions of officers and employees, stipulates that if corporate ethics and interests conflict with each other, corporate ethics should be prioritized and acts contrary to corporate ethics should never be performed. In addition, payment of any money or provision of convenience that is against the law is prohibited. Moreover, we prohibit the provision and receipt of economic benefits that may not be valid in the light of common wisdom, such as cash rewards and excessive entertainment. For entertainment, we apply and manage in accordance with management rules on entertainment, and we have set special precautions especially for entertainment with government officials including those from foreign governments. In order to thoroughly prevent corruption, we carry out educational activities for employees, such as conducting ethics training based on the Code of Ethics and Conduct every year, and monitor the status of entertainment. In FY2020, Daiwa Securities Group did not have any serious matters of note such as violations of laws and regulations related to the prevention of corruption.

For details, please click here

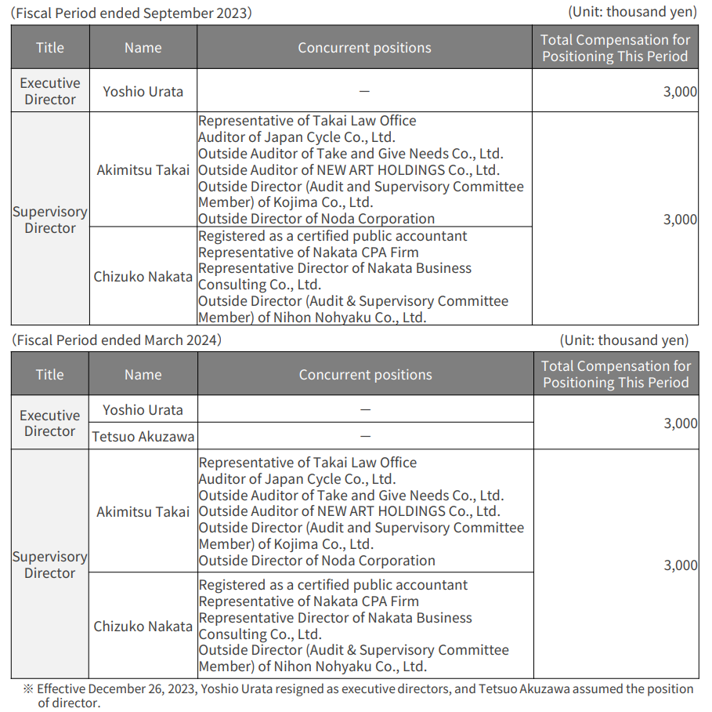

Officers

Click here for career summaries.

Accounting Auditor

| Title | Name | Description of compensation | Total compensation (Fiscal Period ended September 2023) |

Total compensation (Fiscal Period ended March 2024) |

| Accounting Auditor | Grant Thornton Taiyo LLC | Compensation based on auditing duties | 15,000 | 17,000 |

Whistleblowing System

The Asset Manager has established a whistleblowing system for all employees (part-time, contract, seconded from other companies and temporary).

This system enables anonymous reporting and, in compliance with the Whistleblower Protection Act, prohibits firing, disciplining, retaliating against or subjecting the whistleblower to any other disadvantageous treatment on account of their report.

Protection of information assets

The Asset Manager has established Rules for the Protection of Information Assets with the

aim of properly utilizing corporate information and preventing unauthorized access and loss or leakage of corporate information.

The regulations ensure thorough information management by stipulating the management of confidential information, access restrictions for outsiders, prevention of information leaks,

maintenance of information systems and education and audits related to information system management.

Regular Compliance Training

The Asset Manager regularly conducts training for all employees (part-time, contract, seconded from other companies and temporary) to raise compliance awareness.

Same-Boat Investment

| Sponsor group | Number of units | Holding ratio |

| Daiwa Securities group Inc. | 378,707units | 15.73% |

| Good Time Living Co.Ltd. | 10,853units | 0.45% |

*As of end of period ended March 2024

Major Investors

Click here for List of Top 10 Investors